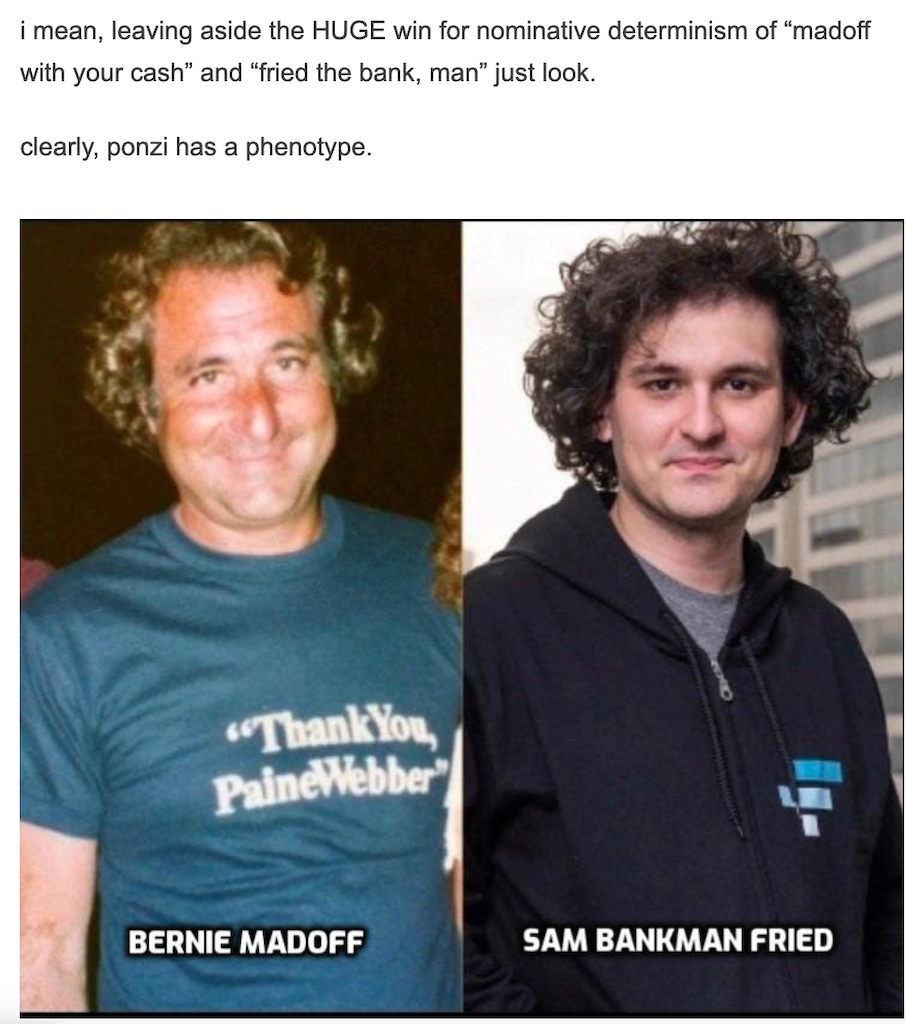

Could a better name have been invented than Sam Bankman-Fried? Or as Clif High puts it now, Fried Bankman?

The sudden nuclear blowup of the FTX crypto exchange on Friday, November 11, only three days after the fraud-riddled, Super Blood Moon, Full Lunar Eclipse midterm election, was what financial wizards would call a Black Swan event, utterly unpredictable, and with colossal consequences, including an entirely unexpected eureka moment with the discovery that since March 2022, billions upon billions of American taxpayer money funneled into Ukraine to supposedly fund the proxy war against Russia, was actually a money-laundering scheme.

Turns out, some of those billions were funneled into the FTX crypto exchange in Ukraine, then laundered into currency and sent back to the US to get Democratic politicians elected (and then owned).

Check this out. Interesting timing, eh?

Yep. Our taxpayer dollars, no matter whether we call ourselves Democrat, Republican or Independent, are being used to bribe Democrat politicians, including those in the current administration, to go along with whatever is the larger agenda. Get the picture?

And guess what? Buy-den has just requested another $37.7 Billion for Ukraine.

(Hmmm . . . might blackmail also be involved? What does Zelensky have on the Bidens?)

This request was made yesterday, after the XRT exchange bankruptcy that should have stopped the flow to Ukraine, and that in fact did stop the flow, but, they hope, temporarily; they hope nobody is noticing . . .

Clif High, in a conversation with Bix Weir, used his predictive linguistics (which maps emotional intensity) to give us an outline of what’s going on and what to expect. He drew a short vertical line, to denote the emotional intensity that the XRT exchange bankruptcy detonated, as many thousands of investors lost millions, even billions, just like that. Poof! But, Clif adds, in three weeks, between December 13 and 15, there will be another vertical line for emotional intensity and the next one will make the first one look like peanuts, rising, suddenly, much much higher.

Sam Bankman Fried, or “Fried Bankman,” as Clif calls him, remember, the so-called millennial mastermind with a nebbish body who is behind the crypto exchange that suddenly failed and crashed his own personal net worth from billions to zero, is 30 years old, Saturn Return time. Your first 30-year cycle is over, Sam. Did you learn anything?

And, that Trump declared his candidacy for president in 2024, during last night’s hour long, as usual informative, but in an unusually low key frequency calling for unification . . . not related? Not part of “all one thing?”

Now step back a bit and check out the SBF hagiography, again thanks to Clif High (whose moniker is SciFi World on Telegram). Definitely worth a read, and almost snookered me in. What I should have asked, while reading it, was just which causes did he consider worth donating to? My friends, he’s not just the second largest Democrat funder, after George Soros, he’s also a woke WEFFER.

https://web.archive.org/web/20221027181005/https://ww

w.sequoiacap.com/article/sam-bankman-fried-spotlight/

I’ve held on to this next tiny tweet for about a month. Now is the perfect opportunity to post it.

Yes, what WAS the plan for. Because even the best made plans have a way of dissolving into dust. Remember, remember: (primal, death/rebirth) Pluto Returns to its natal degree this year for the very first time in the birthchart of the U.S.A.

Could the FTX debacle be a matter of ‘Money-Laundering on behalf of Top-Tier Money Laundering’? (Think about it . . . ‘Bank-Man’ qualifies as an infant in the long-game.)

As an example . . . Pension Funds come to mind as a Canadian Pension Fund was cited as a big loser in the recent FTX debacle . . .

Pension Funds represent a financial basket filled with funds that actually represent ERG or units of ”WORK’ rather than ‘pie-in-the-sky’ investment created out of thin air.

Pension Funds initially were designed to invest in secure financial products and logically so, as recipients paid-in while ‘working’ to secure a source of income when no longer ‘working’.

Congress eventually relaxed the rules for Pension-Fund investment and a quick visit with a pension fund manager makes the present latitude in pension fund investment a bit more eye-opening.

Mere Supposition:

Is it possible that the FTX scandal provides cover for significant losses that may have occurred within various financial institutions that are presently considered above-board and ranked as reliable?

‘Time May Tell’

Verry interesting! Thanks, Rose.